Everything about Pvm Accounting

Table of ContentsSome Known Facts About Pvm Accounting.Some Known Incorrect Statements About Pvm Accounting The Pvm Accounting PDFsThe Best Guide To Pvm AccountingOur Pvm Accounting IdeasTop Guidelines Of Pvm AccountingPvm Accounting Fundamentals Explained

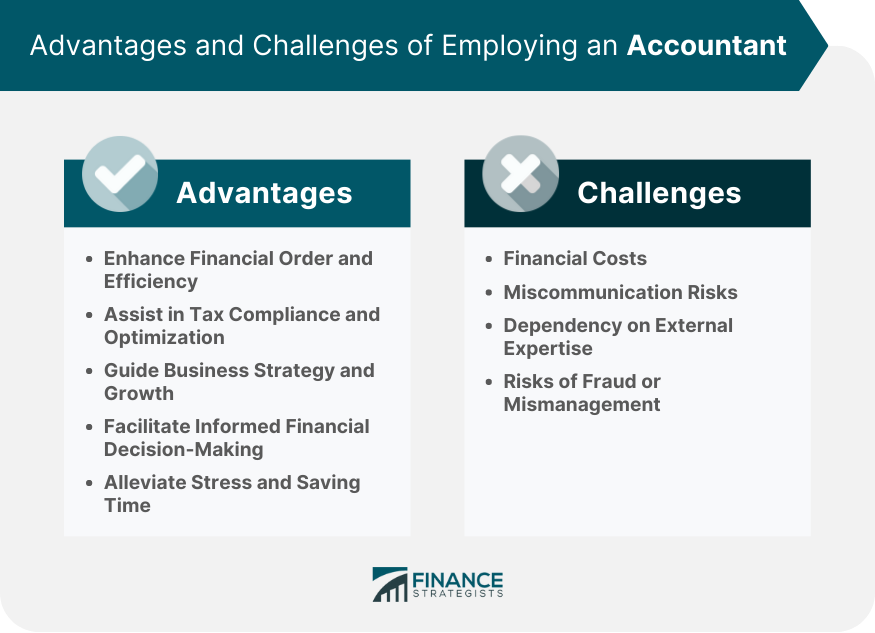

Is it time to work with an accountant? If you're an SMB, the best accounting professional can be your friend. At BILL, we've seen firsthand the transformative power that entrepreneurs and accounting professionals can unlock together (construction bookkeeping). From improving your tax obligation returns to assessing funds for boosted productivity, an accounting professional can make a large distinction for your organization.

This is an opportunity to gain insight into how professional monetary advice can equip your decision-making process and establish your company on a trajectory of ongoing success. Relying on the dimension of your organization, you might not need to work with an accountantat least, not a permanent one. Lots of local business get the solutions of an accounting professional only during tax time.

Are spread sheets taking over more and even more of your time? Do you discover on your own frustrated tracking down receipts for expenditures rather of focusing on work that's closer to your core goal?

Everything about Pvm Accounting

An accountant, such as a cpa (CPA), has actually specialized understanding in economic monitoring and tax conformity. They stay up to date with ever-changing regulations and finest practices, ensuring that your organization stays in conformity with legal and governing demands. Their expertise enables them to navigate complex economic matters and provide accurate dependable recommendations customized to your certain service requirements.

They can use you recommendations, such as how similar companies have effectively navigated comparable scenarios in the past. Just how much is your time worth, and just how much of it are you investing on firm finances? Do you regularly invest time on monetary statement prep work as opposed to working with company management? Finances can be time consuming, specifically for small company owners that are already juggling numerous duties - construction accounting.

More About Pvm Accounting

Accountants can take care of a variety of tasks, from accounting and economic reports to pay-roll processing, liberating your timetable. When it pertains to making economic decisions, having an accountant's suggestions can be incredibly beneficial. They can offer economic evaluation, scenario modeling, and forecasting, enabling you to examine the possible influence of various options before deciding.

Not known Details About Pvm Accounting

For those who don't already have an accounting professional, it may be difficult to understand when to reach out to one. Every organization is various, however if you are facing obstacles in the following areas, now may be the appropriate time to bring an accounting professional on board: You don't have to compose an organization plan alone.

This will certainly aid you develop a knowledgeable financial strategy, and give you a lot more confidence in your monetary choices (financial reports). Which legal framework will you select for your business.?.!? Working together with an accounting professional guarantees that click for source you'll make enlightened decisions regarding your firm's legal structureincluding recognizing your choices and the benefits and drawbacks of each

Pvm Accounting Things To Know Before You Buy

Local business accountancy can become complicated if you do not recognize just how to manage it. Luckily, an accountant understands exactly how to track your finances in a variety of practical methods, including: Establishing up accounting systems and arranging monetary records with aid from accountancy software application. Aiding with cash money flow management and giving insights right into income and expenditures.

Assessing costs and advising methods to create and adhere to budget plans. Providing evaluation and reporting for notified choice making. Keeping you ready for your income tax return all year long. Aiding you with the month-end close. Maintaining a electronic paper route for meticulous record maintaining. This is likely one of the most common factor that a tiny to midsize service would certainly hire an accountant.

Some Ideas on Pvm Accounting You Need To Know

By functioning with an accounting professional, businesses can reinforce their lending applications by offering much more precise economic info and making a much better case for financial practicality. Accounting professionals can additionally aid with jobs such as preparing economic papers, examining monetary information to analyze credit reliability, and developing a comprehensive, well-structured car loan proposal. When points transform in your service, you desire to ensure you have a strong handle on your funds.

Get This Report about Pvm Accounting

Accountants can aid you determine your business's worth to help you safeguard a reasonable offer. If you determine you're prepared for an accountant, there are a few basic actions you can take to make certain you find the right fit - https://www.behance.net/leonelcenteno.

Comments on “A Biased View of Pvm Accounting”